Sole Proprietor, Partnership, or Corporation Are Eligible

Generally, whether you are a Pharmacist (Rph), Registered Pharmacy Technician (RPHT), Nurse Practitioner (NP), Registered Practical Nurse (RPN), or Personal Support Worker (PSW), whose total taxable revenues are $30,000 or less annually, you are eligible to collect and remit GSH/HST to the government for business-related expenses.

How It Works:

You can claim input tax credits (ITC) for the amount of GST/HST you paid on business expenses. For example, if you purchase materials, laptops, cell phones, gas, vehicles, and even some food expenses from a vendor in the course of business, the government will provide you with credit for the amount of GST/HST you paid on the purchase. Therefore, any GST/HST you pay on qualifying business expenses does represent real costs to your business. If you do not register, you lose such benefits.

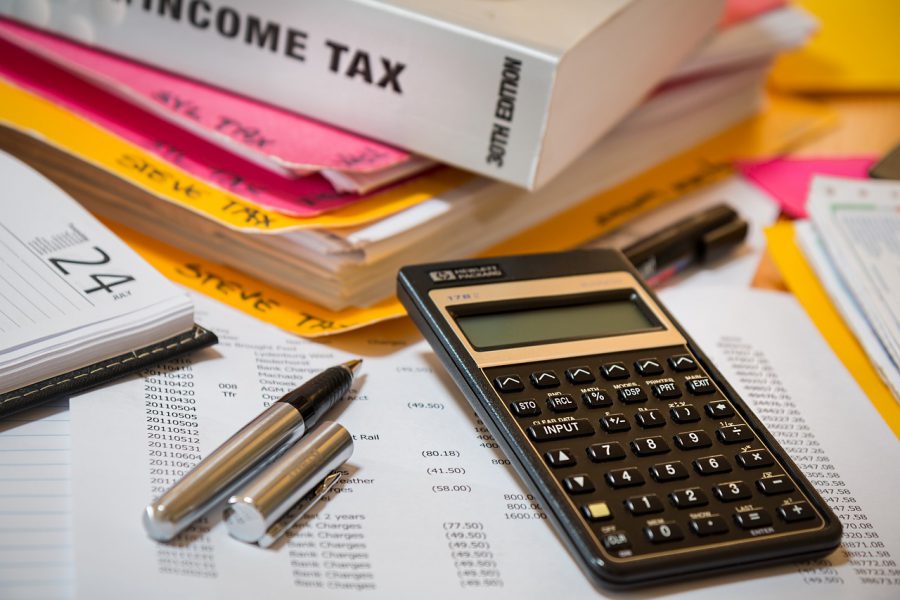

Keep Track Of Your Expenses

As previously mentioned, business expenses can be any number of goods and services purchased for any day-to-day necessities related to running things smoothly. You can find some general information for GST/HST here.

Come tax season, you will be obligated to give the total amount to the government, so keeping track and staying organized is very important!

In Conclusion

The primary benefit of collecting HST/GST is that candidates can keep an account of expenses they have incurred, specifically the HST/GST they have paid. Candidates have the ability to use this expense as an input tax credit to their total GST/HST owing. This lowers the total amount of GST/HST that candidates end up providing to the government, which in turn makes the candidates more money!

Contact your Account Manager today and start saving!